Mortgage rates on the decline while applications rise: Freddie Mac

The average 30-year fixed-rate mortgage was 6.95% for the week ending June 13, according to Freddie Mac's latest Primary Mortgage Market Survey.

Freddie Mac proposes product to help homeowners tap home equity without losing record low mortgage rates

New Freddie Mac product would help homeowners tap their home equity without losing their existing low-rate first mortgages.

Foreclosures on the rise again nationwide — A look at the hardest hit states

More Americans lost their homes in May as foreclosures move higher.

50 percent of Americans saving for college don't know about a 529 savings plan: survey

Despite the many advantages 529 savings plans provide, many Americans are not using them as part of the education saving strategy, a recent Edward Jones survey said.

Soaring insurance rates drive auto insurance shopping rates higher: report

Shopping rates for new auto insurers climbed in January and February 2024, rebounding from a dip in the previous quarter.

Mortgage rates fall but only slightly as home prices continue rising

Home prices may still be up, but mortgage rates dipped down to just below 7% this week.

Unemployment increased just slightly despite the US adding 272,000 jobs

Over 270,000 jobs were added in May, yet the unemployment rate still rose, fueling economic concerns.

71 percent of Americans waiting on interest rate cuts before hunting for homes: survey

Sixty-seven percent of Americans still dream of owning a home, but 71% said they are waiting for mortgage rates to drop before entering the market, according to a recent BMO Financial survey.

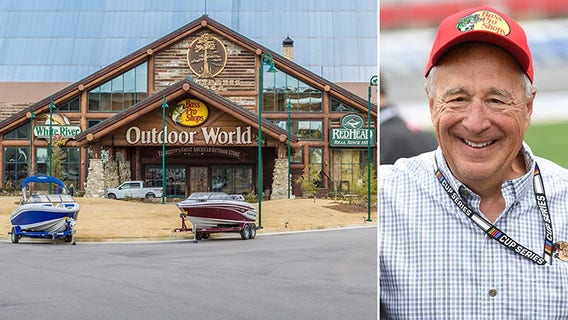

Bass Pro Shops' CEO says brand will focus on affordability amid Inflation

Johnny Morris, CEO and founder of Bass Pro Shops, says inflation is 'very real,' and brand will focus on affordability.

A large percentage of first-generation students have been impacted by FAFSA challenges

FAFSA issues have caused minority students to delay attending college and have led to severe stress and anxiety for other prospective students.

Dow hits 40,000 for first time

The Dow Jones Industrial Average crossed 40,000 for the first time ever Thursday as investors celebrated solid earnings and a slight easing of consumer inflation last month.

'Winflation': Breaking down higher costs for fans of successful sports teams

"Winflation," a phenomenon where the cost of supporting sports teams rises with their success, is reshaping the fan experience, distancing sports from their working-class origins, and imposing significant financial burdens on enthusiasts globally.

Mortgage rates push higher with no relief in sight: Freddie Mac

The average 30-year fixed-rate mortgage was 7.22% for the week ending May 2, according to Freddie Mac's latest Primary Mortgage Market Survey.

Interest rates not changing until inflation cools, Federal Reserve says

The Federal Reserve announced its decision to maintain its key interest rate at a two-decade high of roughly 5.3% amid ongoing concerns about high inflation.

Peacock is getting a subscription price increase. Here's what it means for consumers

The streaming platform’s new price hike will happen this summer, marking the second time in a year the subscription cost is going up.

Student loan forgiveness: Some may qualify but need to take action by April 30

Seeking student loan forgiveness? Some borrowers who consolidate their loans could qualify, but there’s a key deadline approaching.

Many student loan borrowers missing opportunity to find debt relief in SAVE plan: survey

Roughly 3 in 4 borrowers who make $75,000 or less annually and would benefit from the SAVE plan are not currently enrolled in the plan, a recent Student Debt Crisis Center (SDCC) survey said.

The best food deals and freebies on Tax Day 2024

Tax Day brings food deals and freebies, catering to both those celebrating refunds and those seeking solace after paying taxes.

Some student loan borrowers are getting refunds on top of loan forgiveness, here’s who qualifies

Borrowers enrolled in forgiveness programs that have paid for longer than necessary qualify for refunds.

Home listings are rising, but buyers aren’t buying due to high interest rates

Homeowners are eager to sell, despite make less in profits than they did in 2022.